Coding is usually the history little bit of the brand new puzzle following the 1st strategy structure phase. Although not, it’s much more crucial since the the brand new tips require technical enjoy in the the newest onset. You need analytics education to help you estimate the dimensions of otherwise short an enthusiastic chance are, also to assess the dimensions of the trades will likely be. The difference of manual trading is that possibly the option and make processes is completed quantitatively or trading performance is performed automatically by a machine.

Actually, among the best a means to build your individual unique procedures is to get equivalent tips and manage your optimization procedure. Number such tokens are an optimistic stimulant that may most likely push short-label price increases because of increased profile and shopping buyer availableness. Although not, the brand new life of such speed motions hinges on suffered trading regularity, people involvement, http://www.blacktowndentalsurgery.com.au/2025/05/15/best-on-line-brokers-to-own-trading-and-investing-within-the-march-2025/ and you will larger industry conditions. Fortunately, it predictability tends to make SPTN a nice-looking target to have quantitative systems. The brand new inventory has a tendency to trade in a narrow band, and people system playing with servers studying (ML) at some point figures out they can build consistent profits by purchasing these companies reduced and you can attempting to sell highest. Inside the average times, Papa John’s investments on the upper 20X send rate-to-money assortment thanks to the money-light business model.

What exactly is Decimal Change?

Given the difficulty, price, volume, and will cost you, only quant people as a whole this really is can do. When you are algo traders focus on backtesting having fun with historical study, quant buyers extensively fool around with statistics, statistical models, and you can generous study formations in order to assume coming market deals. Decimal trade is a kind of field approach one to relies on mathematical and you may statistical models to understand – and frequently do – possibilities. The newest designs is actually driven from the quantitative research, that is in which the method becomes the term out of. It’s seem to called ‘quant trading’, or possibly only ‘quant’. Quant trade has become specifically popular simply for the speed and you may efficiency of operation.

The advantages and you can downsides away from quant change

While the mathematics-savvy students put on the financing, quant trade punctual turned into a fundamental ability—not an oddity—of larger-currency government. Perhaps the extremely epic very early quant fund try Renaissance Technology, centered by mathematician Jim Simons within the 1982. Their flagship Medallion Fund printed staggering yearly production by utilizing analytical designs one monitored industry defects. Renaissance rented better-tier scientists rather than fund veterans, proving you to state-of-the-art math and you can coding you are going to trounce traditional procedures more time. The final part to the decimal trade puzzle is the procedure from risk government.

A quant, short to own quantitative expert, try a monetary elite whom spends mathematical models, statistical procedure, and you can computers algorithms in order to evaluate industry investigation and you will pick trading possibilities. Quants are generally involved in developing automated change options that can execute trades based on predefined procedures, tend to from the higher speeds and you may volumes. They could specialise in the components including higher-volume change, algorithmic trade, otherwise exposure management. Decimal change requires the entry to computer system algorithms and you can mathematical habits to execute investments for the financial areas based on quantitative investigation. The basis for the approach are investigation—historic costs, volumes, and market symptoms that will be analyzed to make predictions in the coming market moves. Quants, otherwise quantitative investors, do complex patterns that can processes this information instantly generate get or promote indicators.

Following of course you can find the newest vintage group of psychological biases – worry and you may avarice. These could often trigger below- or higher-leverage, that may lead to strike-upwards (i.e. the new account guarantee heading to zero or bad!) or quicker winnings. According to Bureau from Labor Statistics research, the brand new median annual buy economic experts inside the 2022 are $95,080, because the high ten% gained more than $169,940. But not, in neuro-scientific quantitative analysis, this isn’t uncommon to find ranks that have printed wages from $250,000 or maybe more. Just as in very professions, the greater amount of feel you’ve got, the greater a paycheck you can command. Hedge financing or any other trade organizations generally spend the money for most, when you are an entry-top quant condition will get earn merely $125,one hundred thousand otherwise $150,000.

When you are fund for example WorldQuant was with their AI equipment for years – inside look, inside the predictive modeling along with composing password – the use of LLMs to devise change tips is pretty novel. In the a good 46-web page writeup on hedge financing’ entry to AI prepared last Summer by the You.S. Senate Panel to your Homeland Security and you may Governmental Items (where WorldQuant or any other significant participants such as Citadel and you can Renaissance Technologies participated), LLMs had been stated only if. Rate suggest reversion steps focus on the idea that prices tend to move straight back on the their average after deviating. Rather than development-after the tips, this approach assumes on one to tall price moves are short-term and certainly will ultimately opposite.

Impetus exchange as a result of algorithms takes away psychological decision-to make and processes higher investigation kits effectively. With more than 90% away from fx deals today addressed because of the algorithms 1, a properly-crafted energy approach provide a competitive advantage. Such steps rely on automation, sturdy exposure management, and comprehensive backtesting to perform effectively.

Concurrently, one must also provide outstanding feel inside quantitative research. The brand new pay and you may pros that include to be a quant individual seem to be slightly effective. Nevertheless, those who desire to go into which increasingly competitive industry must features individuals overall performance.

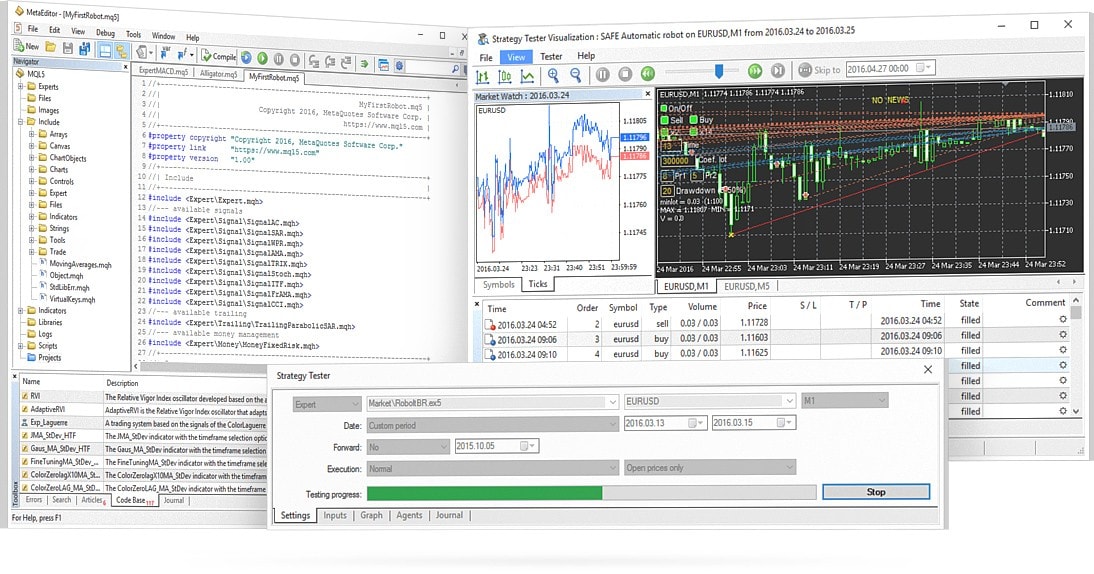

As well as be seen, quantitative exchange is actually an incredibly state-of-the-art, albeit very interesting, area of quantitative money. We have virtually scraped top of the issue within this blog post and is already getting rather enough time! Whole courses and you will records was written about points that i have only provided a phrase or a couple of for the. Because of this, before you apply to own decimal fund change operate, it is necessary to handle a lot of foundation analysis. At the least you want an extensive record inside the analytics and you can econometrics, with a lot of knowledge of implementation, via a programming words including MATLAB, Python or Roentgen. To get more advanced procedures during the higher regularity end, you skill lay has a tendency to is Linux kernel amendment, C/C++, assembly programming and you may community latency optimization.

Exactly how much Manage Hedge Financing Quants Generate?

Quants have a tendency to produce password one finds out locations having an extended-condition mean and you may emphasize whether it diverges of it. If it diverges right up, the computer usually assess the likelihood of a profitable brief change. Want to try aside using an automatic program, although not certain that your’re also in a position for quant?

When you’re an individual is do quant trade by the analysing analysis and you may decision making manually, algo exchange utilizes computer programs to make these types of behavior shorter and better. The two means aren’t mutually private, as numerous algorithmic procedures is actually rooted in quantitative designs, combining investigation-motivated information with automated delivery to have finest overall performance. Decimal experts, known as only “quants,” are financing professionals who build complex analytical models so you can anticipate rates and relieve risk. As the monetary segments have become increasingly complex, of numerous hedge money have efficiently utilized quantitative experts to identify the fresh opportunities to make money. An example to learn just how quantitative change works is actually environment forecasting.