Articles

This might imply using more hours inside than simply you would organized to possess the brand new benefit of your wellness. As with any investment, somebody may need to waiting some time to feel a complete feeling of the money. For the time being, there are a number of actions you can take to save your self safe on the months ahead.

- While you are not knowing for those who gotten the cash, there is a good way to check on using your Irs membership online, income tax advantages state.

- How many banking institutions on the list improved from 52 within the next one-fourth 2023 in order to 63 inside earliest one-fourth 2024.

- The brand new competitive Bash-Off by the White House from a lot of time-term Treasury production and the dollars because the January did.

- These types of ties earn attention centered on a combination of a fixed rates and a varying rates which is linked with the speed from rising cost of living, because the mentioned by the Individual Rates Index to own Metropolitan Users (CPI-U).

RHB fixed put costs

Moreover it form the ways we the decelerate and you can getting less effective whenever working in the warmth. Plus it’s work pros, too, who find that they can’t think quite as obviously to your months if heavens conditioner can be’t match rising heat. In comparison, a year ago’s listing-breaking Us hurricane season brought about a projected $60-$65 billion inside the monetary loss. High temperatures and can escape all of our attention since the analysis to your its consequences are not having plus the problem is difficult to quantify. Surveying the new wreckage away from a warm storm, we are able to calculate its cost for the discount and you can cost inside the lifetime. It’s harder to measure the newest impression from something because the insidious and you may widespread since the rising june temperatures.

Better fixed deposit rates to own an excellent 6-month and you may 12-day connection symptoms

Ally Purchase Advisors and you may Friend Invest Securities try completely possessed subsidiaries from Ally Financial Inc. Bonds goods are Not FDIC Covered, Not Financial Guaranteed and may also Eliminate Worth. While in the his https://happy-gambler.com/smart-mobile-casino/ period, Friend could have been consistently recognized by consumers plus the globe since the “finest in class,” in addition to eleven recognitions to the Currency Magazine’s Better On the web Financial institutions list. Within the 2021, Talwar and you can Friend disturbed once more, best the industry within the getting rid of overdraft fees forever. The brand new service is even revising standards to have everyday revocable trusts, labeled as payable to your passing accounts.

If you are costs spent on and then make fixes are presently allowable, the expense of improvements to business possessions must be capitalized. Have fun with our helpful instructions and you can service services to aid create all of the banking easier. Reinvest the money within the an alternative name put (either to the interest incorporated, otherwise following the focus is actually paid to you). It’s quick and easy in order to roll-over as well as put financing to the identity put during the readiness playing with NAB Web sites Banking or the brand new NAB app. People that receive SSI and you may Public Defense, and people that already been taking Personal Security prior to Will get 1997, likewise have a good modified plan that it month.

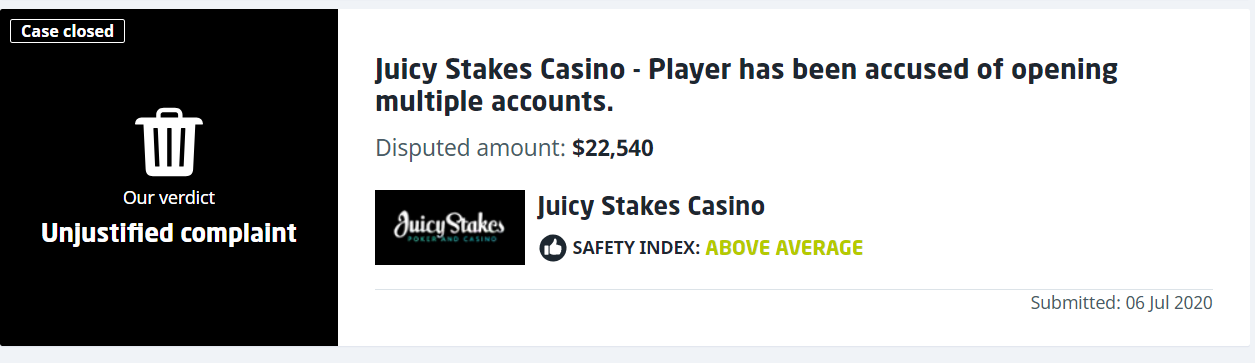

Thus keep specified restrictions in mind whenever stating gambling enterprise incentive money. Don’t hurry on the catching a flashy $one hundred added bonus – large isn’t usually best. Always check the brand new conditions and terms ahead of saying a no-deposit added bonus to make sure your’re also delivering genuine worth. This year-end taxation-planning book is based on the current federal tax legislation, rules. It’s subject to alter, particularly when more taxation laws is actually introduced from the Congress before prevent of the season. Although this book brings a general design, your unique issues deserve custom attention.

When it comes to your benefit amount, even if, there are a few issues which can apply at just how much your discover. If you need high rates, consider the financial institution of China (2.50% p.a great.) or ICBC (2.40% p.an excellent.) with just $500 to own an excellent 3-day tenor. The fresh not so great news is that referring that have high minimal put level of $a hundred,100000. If you don’t fully grasp this number, HL Financial is not also an alternative to you personally.

Finest 5% Interest Discounts Account away from 2024

To make sure, many of the stated opportunities need savers to stay place to possess a designated time, and may require some financing getting sacrificed when they cashed at the beginning of. However, while the economy will continue to work and you can rising cost of living is actually however more than the brand new central bank’s 2% address, forecasts for how much prices may come down just in case features end up being quicker certain. In the avoid away from 2008 thanks to mid-2022, such Computer game stability had plunged by the 97%, regardless of the price-hike hump inside 2018. These short Dvds are very responsive to rates of interest; they’lso are not “sticky” at all. Remark the features and Dangers of Standardized Alternatives pamphlet one which just initiate change options.

Concurrently, damage in a few mortgage portfolios, including place of work features and bank card finance, continues to guarantee monitoring. These problems, in addition to investment and you will margin pressures, will continue to be matters of ongoing supervisory focus because of the FDIC. The increase inside noncurrent financing stability continued certainly one of non-owner occupied CRE finance, driven from the workplace money in the prominent financial institutions, people who have possessions greater than $250 billion. The following level from banking institutions, those with full property anywhere between $ten billion and $250 billion inside the property, is additionally proving some stress inside non-manager filled CRE money. Weakened interest in work place is actually softening assets beliefs, and better rates of interest try impacting the financing high quality and you can refinancing feature of office and other type of CRE money.

Why are an educated Highest-Give Deals Account?

Beginning or rolling more than an expression deposit, for a phrase higher than 2 yrs, is not available in part or thru mobile phone. Depending on the latest research in the Personal Defense Administration, regarding the 7.cuatro million people discovered SSI every month. The thing that makes reports and cost to have We securities talked about for the a great site in the rising cost of living? The fresh results of these securities is actually directly linked to the rates out of rising cost of living. Indeed, Show We deals ties is actually a kind of You.S. authorities bond that is designed to guard against rising prices. These ties secure focus based on a mix of a predetermined speed and you will a variable rate which is linked with the pace from inflation, since the mentioned from the Individual Rates Index to have Metropolitan Consumers (CPI-U).