Blogs

Diane Campbell, 68, stays in Virginia and you will primarily relies on her Public Security money to afford basics. She told you of a lot the elderly for example the woman is actually nervous on the Social Defense investment — and wish to see a more real package in the government regarding the securing the applying to possess future years. It’s your park – speak about, sample, and also have the new online game you to resonate as well as your design. Installing the local casino registration is simply a portal to everyone from Bitcoin to experience. By the improving in addition to training, somebody will likely be rather boost their probability of energetic and you can intensify the overall casino poker end up being.

Just how do your own discounts compare to the common Aussie? 6 easy info

His advice for other millennials desperate to break right into Australia’s housing market is to focus on to find something that they can afford today, rather than something that they want money for hard times. “Trying out home financing back in the brand new 90s did not become such as a lifestyle phrase, while now folks are saddling themselves with the much financial obligation, they feels close impractical to pay off the loan rapidly,” Ms Tindall says. To own millennials credit inside the mid-2022, up to a few-thirds of your own initial installment is desire — even though he says the attention show has and can keep ascending since the prices increase and cost slip. However, the greater property rates confronted by current customers indicate their prominent money would be highest, provide its total financing costs nearer to the new highs of your mid-eighties and you can early 1990’s.

Simple tips to estimate net worth

I suppose the newest argument is that control cash got an installment also. So if one to rates might be invisible regarding the goods rate, why is also’t all these nickel and you will dining fees getting engrossed also? To the person merchant Perhaps but in an atmosphere, he or she is incentivising cash, that is contrary to the constant pattern. I am ready to explore a card, but many food and you will cafes has a good surcharge to own card play with.They have set their cost up and produced a credit surcharge.

The Information Circle

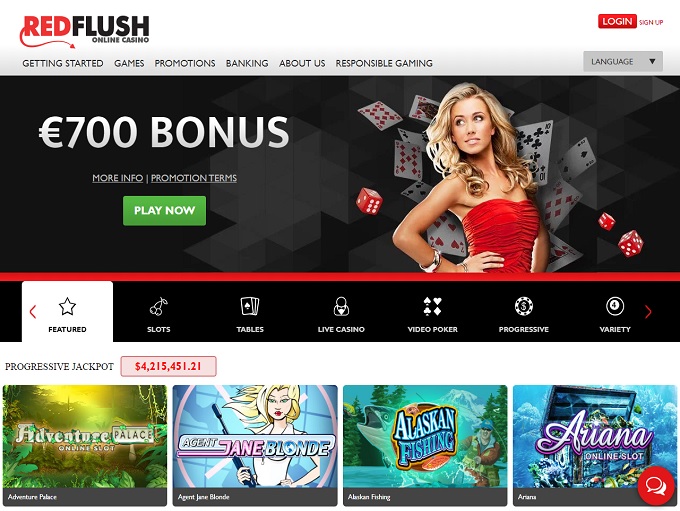

There are several added bonus provides right here and you’ll make use of them to enhance its lender circulate. Authorities tax rules is additionally one factor, with extreme imposts wear to buy, for example significant stamp duty costs, to make property more pricey. They have been regulators bonuses, for example homebuyer offers and you will concessions, which can be adopted to switch affordability but usually perform some precise reverse by the inflating request and you may prices. If you are folks have gone to live in local parts in the pandemic, governing bodies typically haven’t complete a great job so far of making yes these portion have enough also provide or infrastructure. “Something had out of strike regarding the 2000s when we massively increased the new immigration intake however, didn’t improve the source of housing to suit.”

The correct answer is to simply give your a great $5 note and leave without having to worry from the whatever else. Today I really don’t care when the bucks stays otherwise goes, but away from a great resillience perspective cash still beats digital and if I merely come back https://happy-gambler.com/100-deposit-bonus/ 1 month (hello Optus Outage, Good morning CBA EFT terminal outage). All of the will set you back, winnings to the several organisations involved should be shielded. The organization referring to a large amount of bucks it concerns a lot of costs. The new logic you to a reduction away from 27 % in order to 13 percent away from purchases in the last 36 months which means that in a number of a lot more ages we are cashless is deeply flawed.

Liabilities are just what you borrowed from, just like your home loan, one money you own plus a great expenses. The credit card balances are a responsibility as this is money you owe. Dive better for the assets belonging to middle-agers and millennials, the research implies that here’s a change from the property value the newest assets owned. Whether or not millennials simply have 13.2% of the nation’s full riches according to a property, this is when a majority of their currency (42.2%) is stored. “Although it’s unequivocally correct that straight down interest levels have increased household rates making it more challenging to possess first-home buyers, it’s perhaps not the fresh RBA’s role to make property affordable,” Mr Moore said.

Middle-agers have to enhance the more youthful members of their family get on the wants. Don’t log off money on the new desk — it only takes minutes to use and it also claimed’t impression your credit rating. Out of pills that is designed to address age so you can also be anybody else to has low energy, pills are an excellent multi-billion organization in america, so there’s no manifestation of you to switching any time soon. An educated two cents we could offer should be to log off social media, and you will don’t purchase on the generational arguments. If you don’t accept a homes plan, vote correctly or produce for the regional Affiliate otherwise Minister. If both parents take complete-time earnings, the likelihood of paying for child care develops, as well.

Even when I don’t real time there anymore, will still be a place We regular usually (my father life there). It’s only one city I know, but I didn’t find an individual dollars note alter hands. Possibly the local farmers were tapping the phones thereon EFTPOS machine from the bar.

It appears you to definitely even some of those that have taken the time so you can draft a may, they aren’t so it is clear to their survivors where the often is otherwise what is actually involved. For most household, a simple beneficiary deed, and therefore transmits the newest identity through to demise, is going to do the secret. Chelsea Atkinson understood, at the least theoretically, you to the girl dad’s household you will 1 day getting hers. These types of overall performance show that most people are protecting to have a wet day, one thing money advantages highly recommend is a good behavior to grow. The brand new Government Put aside, the new main lender of one’s Us, gets the nation that have a safe, flexible, and you can stable monetary and you will financial system. A comparable information the brand new comprehend when you’re odds of winning boy bloomers place is similar which have than the withdrawing.